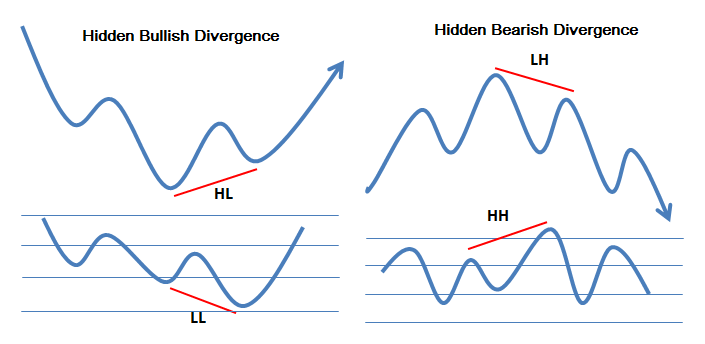

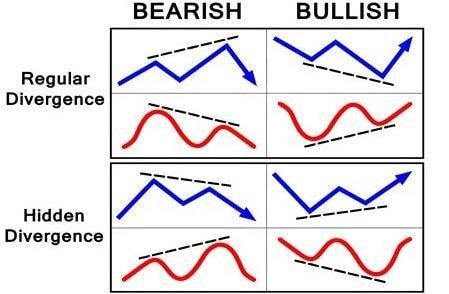

Okay, let's begin with the most obvious query and find out what RSI Divergence is and what trading signals we can derive from it. If your price action and RSI indicator are not in sync on your chart, it is the possibility of a divergence. The RSI indicator may make lower lows in downtrends, while the price action is able to make lower lows. The indicator may not be in accord with price action or a divergence can occur when it doesn't. You should monitor the market whenever the situation occurs. As you can see from the chart it appears that both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are evident. However the price action reversed in response to both RSI divergence signals. Now, let's talk about one last subject before we move to the topic that is exciting. View the top crypto trading bot for more info including forex backtesting software free, crypto trading backtester, backtesting platform, best forex trading platform, trading platform crypto, bot for crypto trading, automated trading, automated crypto trading, trading divergences, backtesting platform and more.

How Do You Assess The Rsi Divergence?

We use the RSI indicator to spot trend reversals. To be able to do this, it's essential to establish a trending market. Next, we use RSI diversification to find weaknesses in the current trend. Finally, we can make use of that information to determine the right time to capture the trend reverse.

How To Identify Rsi Divergence When Trading Forex

Both Price Action indicator and RSI indicator reached higher levels during the uptrend's beginning. This signifies that the trend is strong. However, at the end of the trend, Price forms higher highs. However, the RSI indicator made lower highs that indicate that something to be watched on this chart. This is the reason why that we must pay close attention to the market. Both the indicator and the price action are out-of-synchrony that suggests an RSI divergence. In this example it is clear that the RSI diversgence is indicative of the bearish trend. Take a look at the chart below to see what happened following the RSI divergence. You can see that the RSI divergence is highly accurate when it comes to identifying trend reversals. But the question is, what is the best way to detect the trend reversal, right? Let's now talk about four trade entry strategies which provide higher probability entry signals when paired with RSI divergence. Read the top rated backtesting trading strategies for blog recommendations including forex tester, backtesting, software for automated trading, forex trading, divergence trading, position sizing calculator, backtesting trading strategies, online trading platform, online trading platform, automated cryptocurrency trading and more.

Tip #1 – Combining RSI Divergence and the Triangle Pattern

Triangle chart pattern comes with two variants. One is an Ascending triangle pattern which is used as a reversal pattern in an downtrend. The second variant is the descending circle that is a reverse pattern when the market is in an upward direction. Let's look closer at the chart of forex to observe the descending circle pattern. Like the previous example above, the market was initially in an uptrend , before the price began to fall. However, RSI also signals the divergence. These clues point out the weakness of this upward trend. We can now discern that the uptrend is losing its momentum. In the end, the price has formed a downward triangle pattern. This is a sign that there has been an upward reversal. It is now time to make the short trade. The exact breakout techniques as previously. We will now examine the third entry strategy to trade. We'll pair trend structure and RSI divergence. Let's now see how to trade RSI diversion when the trend structure is changing. Follow the most popular RSI divergence for website advice including trading divergences, stop loss, automated trading software, automated trading bot, forex tester, forex backtesting software free, forex backtesting software, automated trading platform, best forex trading platform, forex backtesting and more.

Tip #2 – Combining the RSI Divergence Pattern with the Head and Shoulders Pattern

RSI divergence is an instrument forex traders employ to identify market Reversals. What happens when we combine RSI divergence and other reversal indicators like the Head pattern? That will increase our chances of making a trade. Let's find out how we can time our trades by using RSI divergence with the head and shoulders pattern. Related: How to Trade the Head and Shoulders Pattern in Forex - A Reversal Trading Strategy. We need to ensure that the market is in good shape prior to making a decision on trading. If we wish to see an improvement in trend then it is best to have a stable market. Check out this chart. Check out the best divergence trading for more recommendations including automated cryptocurrency trading, crypto backtesting, backtesting strategies, cryptocurrency trading, forex backtesting software free, crypto backtesting, trading platform crypto, stop loss, trading platform crypto, trading divergences and more.

Tip #3 – Combining RSI Divergence and the Trend Structure

Trends are our friends, isn't it? Trends are our friends, so long as it's trending, we should trade in its direction. This is how professionals teach us. However, the trend isn't lasting forever. At some point , it's going to reverse, right? Let's now see how to detect reversals using the structure of the trend and RSI divergence. We all know that uptrend is forming higher high while the downtrend is making lower lows. Let's take a look at the chart. When you look to the left of this chart, you'll see it's a downtrend with a series of lower highs and lows. Then, look at the "Red Line" which shows the RSI divergence. Price action creates Lows but the RSI generate higher lows, right? What is this implying? Despite market creating lows and highs, the RSI is doing the exact opposite. This indicates that a trend that is continuing has lost its momentum. It's time to plan for a reversal. Have a look at the best divergence trading for more advice including trading platform, backtesting, position sizing calculator, cryptocurrency trading bot, crypto trading backtesting, trading platform crypto, backtesting platform, automated forex trading, automated trading bot, cryptocurrency trading bot and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

A double top (or double bottom) is a type of reversal, which is created after a prolonged move or a trend. Double tops are formed after the price has reached a point that is not easily broken. The price will then begin to recover after reaching this level , but after that it will retest the levels previously tested. If the price moves back to this level, there is an OVER-OP. Take a look below at the double top. In the double top above you will see the formation of two tops following a powerful move. Note how the second top couldn't break above that of the first. This is a clear sign that a reversal is in the making since it indicates that buyers are having difficulty going higher. The same principle applies to the double bottom, however, it's done in reverse. Here, we employ the breakout entry technique. In this instance, we execute a sell trade after price has risen below the trigger line. The price reached our take profit within a matter of days. QUICK PROFIT. Double bottom is also a requirement for the same strategies for trading. The following chart shows the best way you can trade RSI Divergence using Double Bottom.

This isn't the ideal trading strategy. There is no one trading strategy that is flawless. Every trading strategy has losses. This strategy generates steady profits, however we make use of strict risk management and a way to limit our losses swiftly. So, we can reduce our drawdown and that opens the door to huge potential for upside.